Peerless Info About How To Lower Debt To Equity Ratio

When you pay off loans, the ratio starts to balance out.

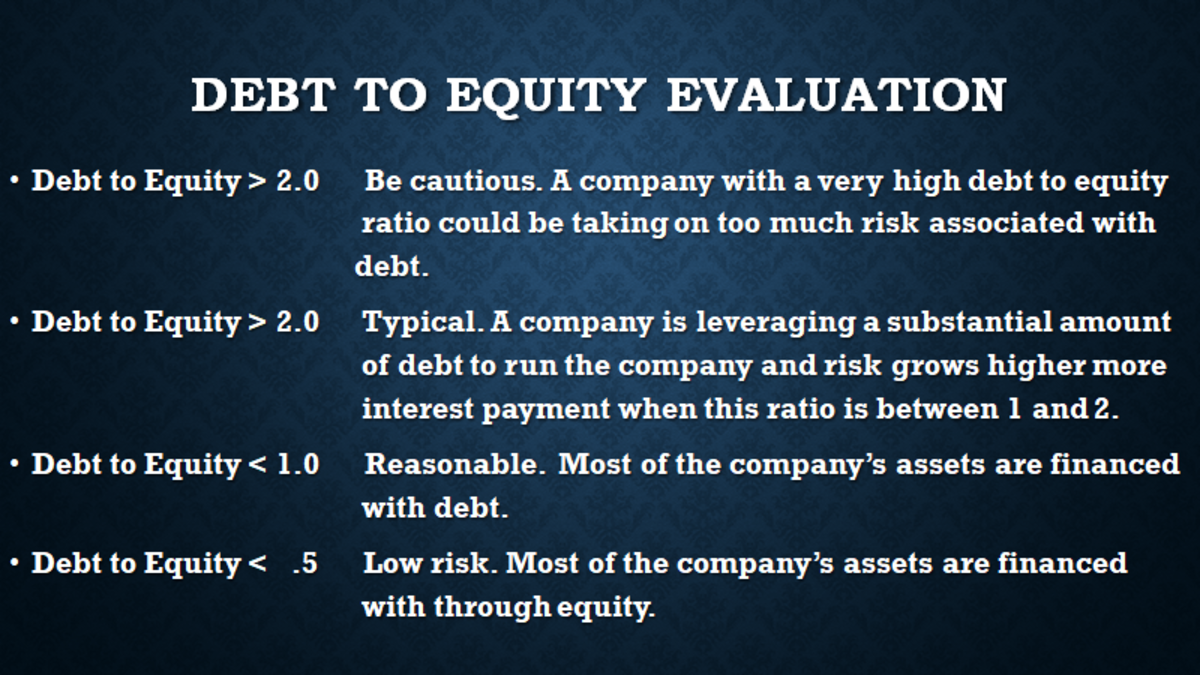

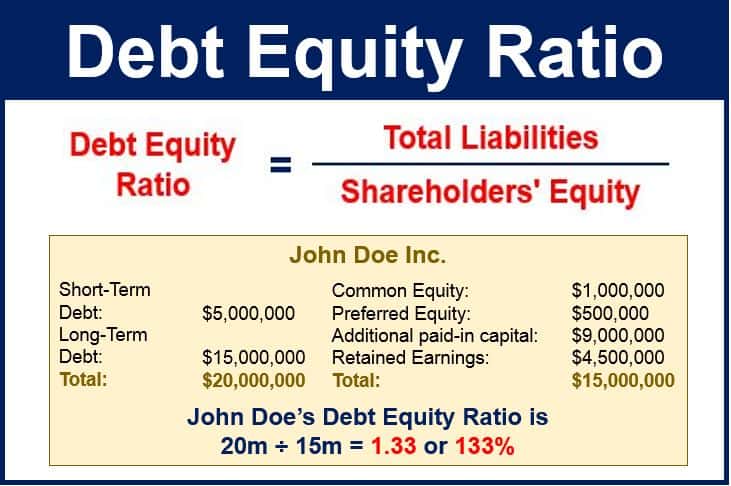

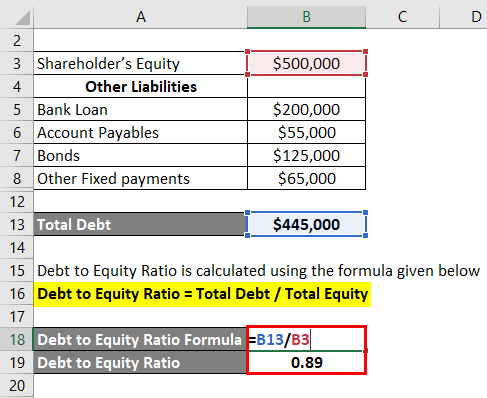

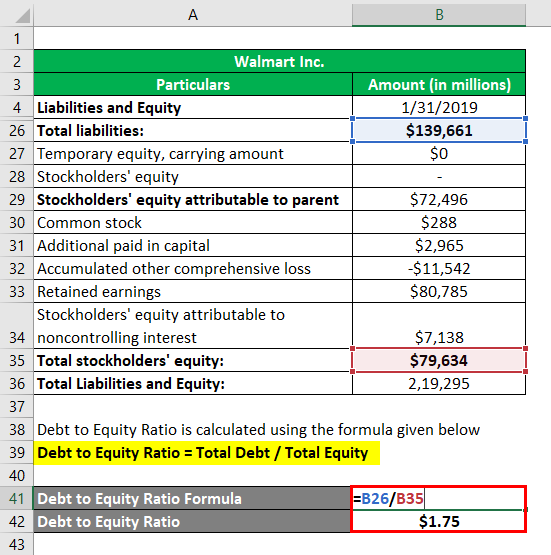

How to lower debt to equity ratio. This is done by giving out the cash in the form of dividends companies generally do this to attract investors as this serves two purposes for the first one. Begin by compiling a listing of all your fundings as well as charge card. Debt to equity ratio = total liabilities / shareholder’s equity.

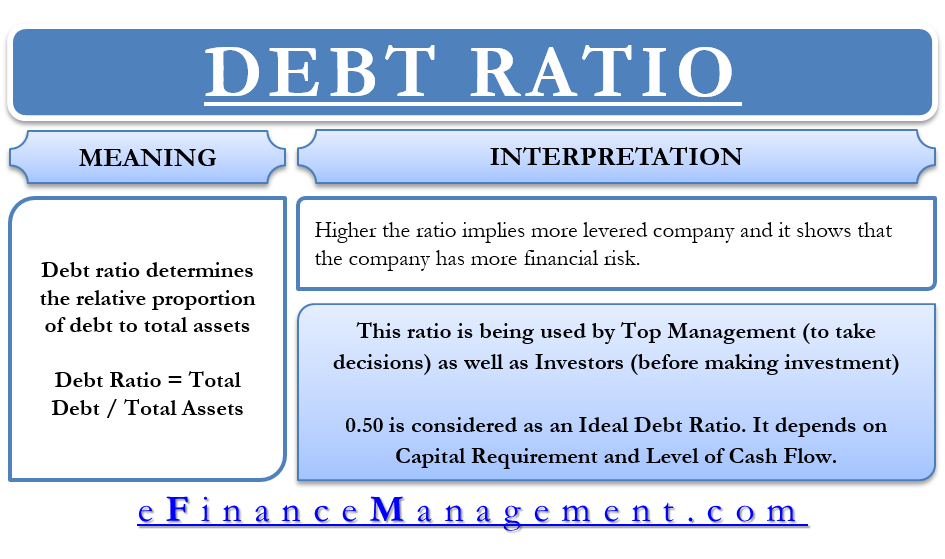

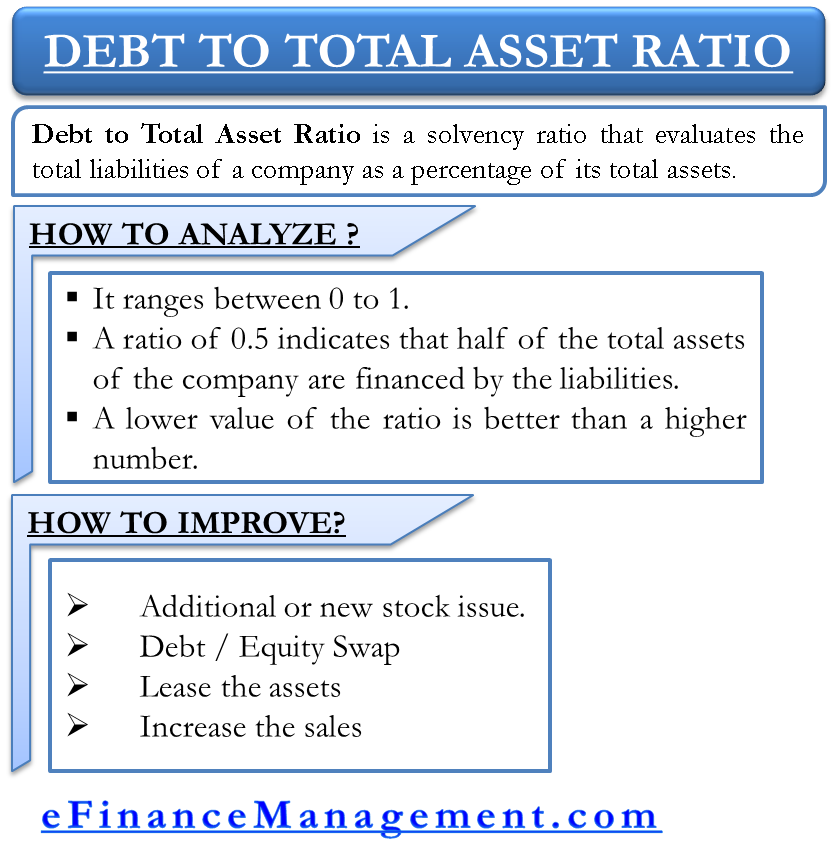

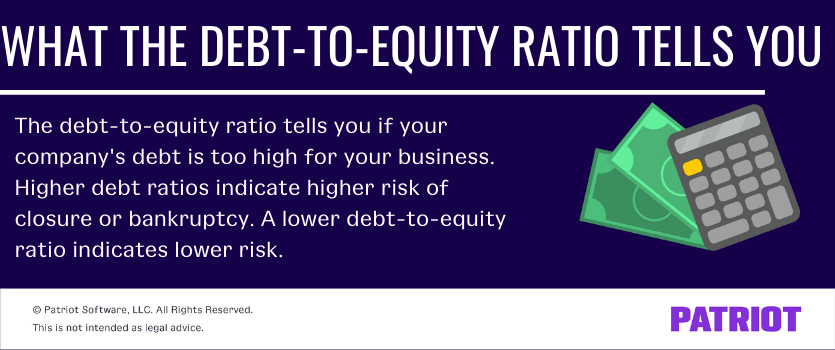

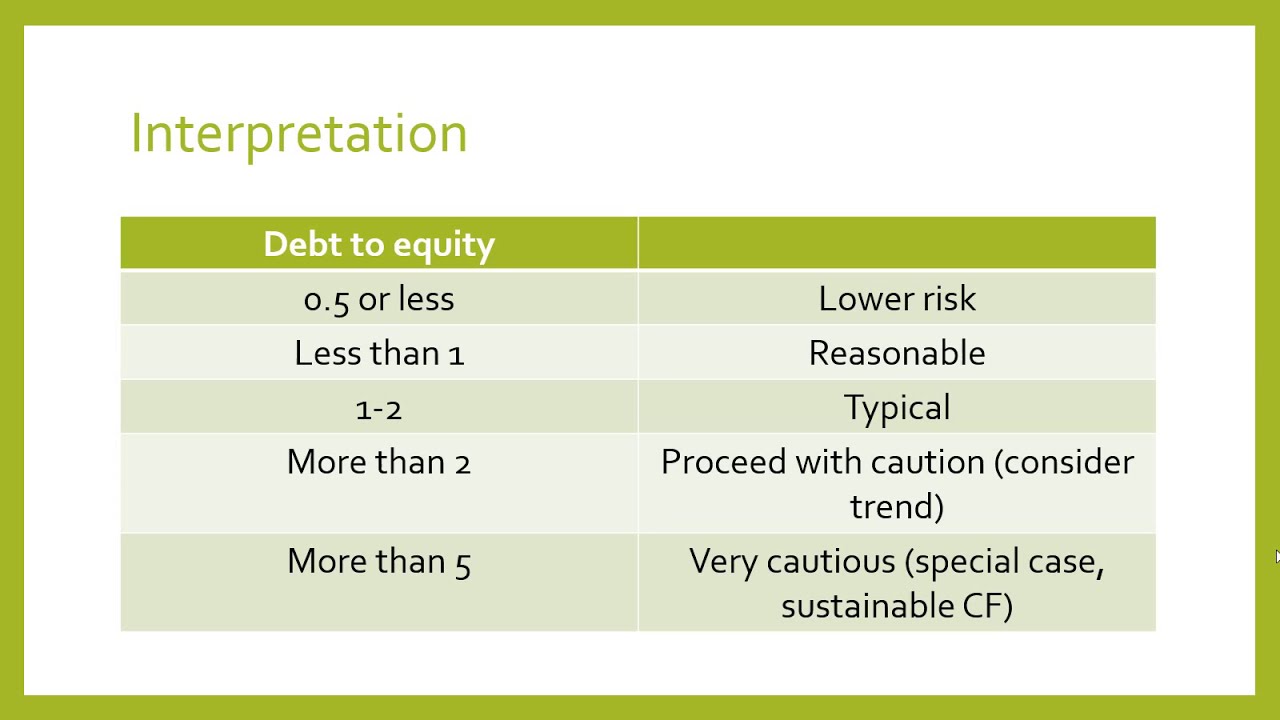

This can be done by paying off some of your outstanding debts or. The d/e ratio measures financial risk or financial leverage. Reduce debt to equity ratio know how much financial obligation you have.

Equity ratio = shareholders’ equity ÷ capital employed; Where, total liabilities = short term liabilities + long term liabilities. Increase revenue and use the new equity to either buy new assets or pay off existing debts.

What is a good debt to equity ratio? Divide the company's total liabilities by its shareholders' equity. One of the most obvious ways to improve your debt to equity ratio is to simply reduce the amount of debt your company has.

As the company’s equity increase, the money returns back to the company. This ratio indicates the proportion of the owners’ funds invested in the overall fund of the company. For example, if your startup owes $30,278 to third parties and has $19,803 in.

First, you can increase your income.

:max_bytes(150000):strip_icc()/debtequityratio.asp_FINAL-0ac0c0d22215418a992fa7facd2354e6.png)

:max_bytes(150000):strip_icc():gifv()/debtequityratio_final-18c02abef4f74c1591dc9b12be962b1b.jpg)